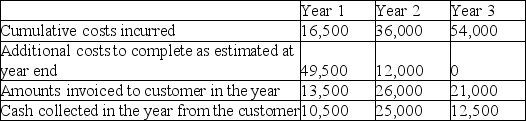

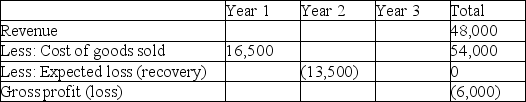

Southtel is a builder of large digital networks.In the midst of the high-tech euphoria,the company bid and won a $48,000,000 contract to build a network for the country of Elbonia.Details on the project over the last three years are as follows:

Required:

Calculate the amount of revenue,cost of goods sold (COGS),and gross profit (or loss)to be recognized in each of the three years.The company uses the percentage of completion method to account for long-term contracts.Record your answer in the following table.

Definitions:

Trust Holdings

Assets held in a trust by one party for the benefit of another, including real estate, stocks, bonds, and other investments.

Tax Rate

The percentage at which an individual or entity is taxed on their income or property.

Employee Stock Ownership Plans

Retirement plans designed to give employees ownership interest in the company by allowing them to acquire stock, contributing to company success and employee benefit.

Tax Advantages

Financial benefits derived from specific tax laws or regulations that reduce the amount of tax payable to federal or state governments.

Q6: Which of the following are scientific hypothesis?

Q7: Assume that a $500 purchase invoice received

Q7: Creation Construction Company (CCC)has contracted to build

Q28: What amount will be included in "cash

Q39: Which statement is correct about financial instruments?<br>A)A

Q39: What amount will be included in "cash

Q65: A scientific hypothesis is a(n)_.<br>A)testable assumption used

Q66: Based on the following information,what amount will

Q68: What issues arise on the subsequent measurement

Q107: Fiesta Corp.purchases a $100,000 face value bond