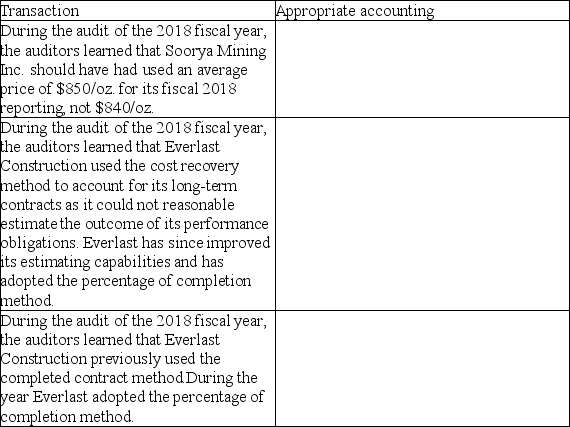

Explain whether each of the following transactions would be accounted for as a change in accounting policy,change in accounting estimate or as an error correction.Assume that the entity reports its financial results in accordance with ASPE and all transactions are material.

Definitions:

Adjusting Entries

These are journal entries made at the end of an accounting period to allocate income and expenditures to the period in which they actually occurred.

Expense Account

An account used to track expenditures or costs incurred by a business or an individual for operational purposes.

Asset Account

An account that tracks resources owned or controlled by a business or individual which have economic value.

Unearned Items

Income received for goods not yet delivered or services not yet provided, considered a liability until the goods or services are delivered.

Q4: Algae builds large ships and uses the

Q10: The method of depreciation was changed from

Q10: Safe Investment Company (SIC)began operations on January

Q13: Micelle Inc.reported credit sales of $700,000 and

Q46: What amount will be included in "cash

Q94: Using the following cost information regarding finished

Q110: Which statement is correct about non-strategic investments?<br>A)IFRS

Q111: Which statement about using the aging of

Q126: Explain the difference between a joint arrangement,joint

Q132: Which statement best depicts the inventory cost