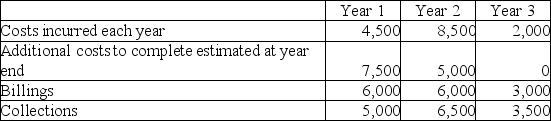

Buildings Ltd.is constructing a residential building in downtown Vancouver for a contract price of $15,000,000.Costs for this contract were initially estimated to be $12,000,000.The company uses the percentage of completion method of revenue recognition,using the cost-to-cost method of estimating the percentage complete.The following information is available:

Required:

a.Calculate the amount of gross profit to be recognized in each year.Show computations in good form.

b.Calculate the amount of revenue to be recognized in Year 2.

c.Prepare all the journal entries required in Year 2.

d.Prepare the journal entry required in Year 3 to acknowledge completion and acceptance of the project.

Definitions:

Principal Payment

A payment towards the original amount of a loan, not including interest.

Warranty Repairs

Services offered to fix or replace defective products within a specified period, as guaranteed by the warranty terms.

Contingency Loss

A potential financial loss that may occur in the future due to uncertain events or conditions.

Q12: Financial statements under the IFRS Conceptual Framework

Q12: Beebo Ltd.provides for doubtful accounts based on

Q15: Simply Manufacturers has signed an order to

Q23: Which of the following is an example

Q24: Which statement is not correct about estimating

Q28: After the devastating tsunami of December 2004,

Q63: Explain the meaning of the cash basis

Q71: Pool Contractors (PC)entered into a contract to

Q75: What determines the direction of heat flow?<br>A)Heat

Q101: Considering how small atoms are, what are