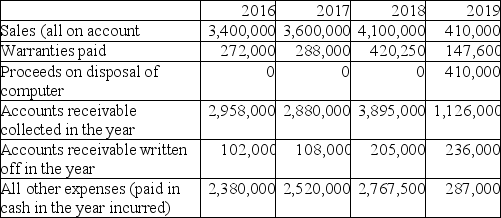

Computer Consulting Limited was started in early 2016 and continued to operate until early 2019,when it was wound up due to disputes between the two principal shareholders.When it started,the company used these accounting policies:

1.Use straight-line depreciation for the firm's only asset,a computer which cost $1,100,000 and has an estimated useful life of four years.

2.Estimate warranty expense as 9% of sales.

3.Estimate bad debts expense as 5% of sales.

Derive the annual net cash flows for 2016 to 2018.For the year-end balance for 2019,assume accounts receivable,allowance for doubtful accounts,and the warranty accrual are $0,as the firm wound itself up during the year and all timing differences have been resolved.

Definitions:

Accounts Receivable

Money owed to a company by customers for products or services that have been delivered or used but not yet paid for.

Income Tax Payable

This represents the amount of income tax that a company owes to the government but has not yet paid.

Sales

The transactions involving the exchange of goods or services for money, reflecting the primary revenue activity of a business.

Free Cash Flow

The amount of cash generated by a business after accounting for operational expenses and capital expenditures, available for distribution or reinvestment.

Q5: Nova Construction Company (NCC)entered into a contract

Q6: Which of the following images could describe

Q6: Which statement is correct about the impact

Q18: Any high risk for a particular technology

Q68: In the chart below,identify the revenue recognition

Q69: Which statement is not correct?<br>A)Cash accounting is

Q86: At a depth of about 10 meters

Q97: Which of the following does not describe

Q108: Which statement is correct about cost allocation

Q118: The following event occurred after the company's