Use the information for the question(s) below.

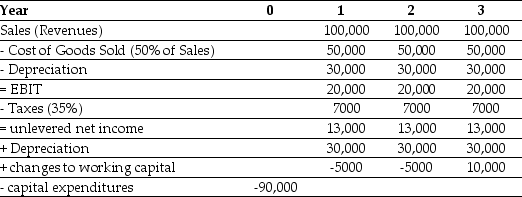

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-Epiphany would like to know how sensitive the project's NPV is to changes in the discount rate.How much can the discount rate vary before the NPV reaches zero?

Definitions:

Electrician

A skilled tradesperson who installs, maintains, and repairs electrical systems and components.

Pilot Device

Control equipment that directs the operation of another device or system, often based on user input.

Two-wired Motor

A motor that is designed to be connected and operated with two electrical wires, simplifying its electrical installation.

Control Circuits

Electrical circuits designed to control the operation of other circuits or devices through the use of signals.

Q8: On the polycistronic mRNA of bacteriophage MS2,

Q16: In mammalian cells, most fatty acid elongation

Q20: Which of the following is seen

Q21: During apoptosis, proteolysis is catalyzed by _

Q23: What is the only reaction of mammalian

Q39: A decrease in the sales of a

Q52: Since your first birthday,your grandparents have been

Q57: Which of the following statements is FALSE?<br>A)Forward

Q63: A company that manufactures copper piping is

Q69: Assuming that Palin's cost of capital is