Use the information for the question(s)below.

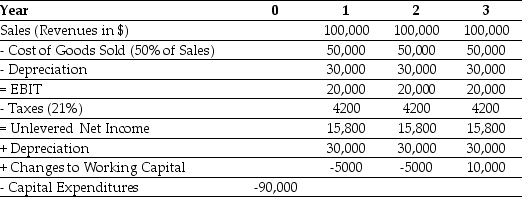

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-Epiphany is worried about the reliability of the sales forecast.How sensitive is the project's NPV to a 10% change in sales?

Definitions:

Canadian Dynasties

Prominent families in Canada known for their significant impact and influence on the country's business, political, or cultural landscape.

Heirs

Legal successors entitled to inherit the property or rights of a deceased individual under the laws of inheritance.

Replacement Planning

A component of succession management focusing on identifying immediate replacements for key roles within an organization.

Succession Management

A strategy to identify and develop future leaders at a company, ensuring a smooth transition and the continued effectiveness of the organization in the face of change.

Q5: Which of the following pathways is activated

Q9: A repetitive mRNA of GAG could produce

Q10: Luther Industries needs to borrow $50 million

Q11: Most steroid hormones exert their effects by

Q12: Larry should:<br>A)reject the offer because the NPV

Q13: The present value of an investment that

Q21: Which of the following hormones binds to

Q55: The amount of your original loan is

Q61: If the interest rate is 7%,the NPV

Q67: You expect KT Industries (KTI)will have earnings