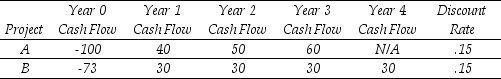

Use the table for the question(s) below.

Consider the following two projects with cash flows in $:

-The internal rate of return (IRR) for project B is closest to:

Definitions:

Negative Alphas

A situation where an investment's return is less than the return predicted by its associated risk (alpha less than 0).

Risk-Free Rate

A revised definition for clarity: The theoretical return of an investment with zero risk, often represented by the yield on government treasury bonds.

Positive Slope

Represents a line or curve on a graph that depicts an increase in value as one moves from left to right, signifying a direct relationship between two variables.

Q4: Wesley Mouch's auto loan requires monthly payments

Q8: Which alternative offers you the lowest effective

Q22: Amphetamine and mescaline are agonists of

Q34: Assuming you currently have 10,000 Bbls of

Q51: A tax free municipal bond pays an

Q55: Assuming that Dewey's cost of capital is

Q56: Which of the following statements is FALSE?<br>A)Many

Q69: A key difference between sovereign default and

Q70: An incremental IRR of Project B over

Q89: The present value (at age 30)of your