Multiple Choice

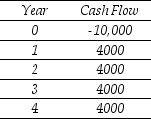

Use the table for the question(s) below.

Consider a project with the following cash flows in $:

-Assume the appropriate discount rate for this project is 15%.The profitability index for this project is closest to:

Definitions:

Related Questions

Q6: Suppose a five- year bond with a

Q8: Which of the following is the first

Q10: Luther Industries needs to borrow $50 million

Q13: Show the reaction (with arrow pushing)for addition

Q20: Which of the following molecules derived from

Q23: In June 2016,the spot exchange rate for

Q28: Which of the following statements is FALSE?<br>A)The

Q51: A tax free municipal bond pays an

Q54: The required net working capital in the

Q57: Which of the following statements is FALSE?<br>A)Forward