Use the following information to answer the question(s) below.

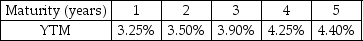

Suppose the current zero-coupon yield curve for risk-free bonds is as follows:

-The price per $100 face value of a four-year,zero-coupon,risk-free bond is closest to:

Definitions:

Instruction

A command or directive given to a computer or device to execute a specific operation or task.

Bureau of Labor Statistics

An agency of the U.S. government tasked with gathering and interpreting statistics related to labor economics.

Employed Category

Refers to the classification of individuals in the labor market who are currently holding a job or are employed.

Paid Employees

Individuals who perform work or services for a company or an individual in exchange for compensation, typically in the form of wages or salaries.

Q18: Lysine methylation in a histone protein produces

Q19: Directors who are employees,former employees,or family members

Q23: E. coli cells achieve a great

Q32: Assuming you currently have 10,000 Bbls of

Q34: Assume that Kinston's new machine will be

Q39: A decrease in the sales of a

Q46: Which of the following statements is FALSE?<br>A)Long-term

Q55: You are considering adding a microbrewery on

Q80: Define the following terms:<br>(a)perpetuity<br>(b)annuity<br>(c)growing perpetuity<br>(d)growing annuity

Q86: The incremental unlevered net income of the