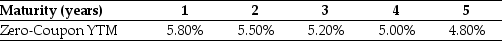

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The price today of a 3-year default-free security with a face value of $1000 and an annual coupon rate of 6% is closest to:

Definitions:

Financial Resources

Assets in the form of money or other valuables that an individual or organization can draw upon to fund its operations, investments, and to secure its future.

Coping Strategies

Techniques or methods that individuals use to handle, endure, or minimize stress and conflict in life.

Hormone

Chemical messengers produced by glands in the body that regulate physiological functions and behavior by traveling through the bloodstream to target organs.

Cognitions

Mental processes involved in gaining knowledge and comprehension, including thinking, knowing, remembering, judging, and problem-solving.

Q8: Which is a possible outcome when guanine

Q9: How does scenario analysis differ from sensitivity

Q15: What is the term used to describe

Q23: What are some common multiples used to

Q28: Which of the following statements is FALSE?<br>A)The

Q37: Suppose you plan on purchasing Von Bora

Q56: The incremental EBIT for the Shepard Industries

Q61: The effective annual rate on your firm's

Q65: The present value of an investment that

Q67: The payback period for project B is