Use the table for the question(s) below.

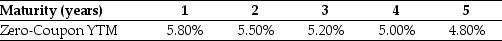

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 2 (the forward rate quoted today for an investment that begins in one year and matures in two years) is closest to:

Definitions:

Content Validity

Refers to the extent to which a test measures all aspects of a given construct or domain of interest accurately.

Construct Validity

Construct validity refers to the extent to which a test or instrument measures the theoretical construct it is intended to measure.

Differential Validity

Differential validity is the extent to which a test predicts outcomes differently for distinct groups, often analyzed to assess fairness across demographics.

Validation Studies

Research conducted to ensure that a tool, test, or method accurately measures what it is supposed to measure.

Q3: The amount that Ford Motor Company will

Q14: Which of the following statements is FALSE?<br>A)When

Q16: Which subunit of E. coli RNA

Q22: How do you calculate (mathematically)the present value

Q25: What site is occupied by the tRNA<sup>fMet</sup>

Q28: The price (expressed as a percentage of

Q33: The present value of the £5 million

Q44: The temporary working capital needs for Hasbeen

Q57: The effective annual rate (EAR)for a loan

Q93: Suppose you plan to hold Von Bora