Use the information for the question(s)below.

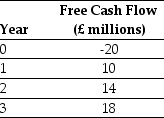

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-Calculate the pound denominated cost of capital for Luther's project.

Definitions:

Legal Entities

Organizations or structures that are recognized by the law as capable of rights and obligations, such as corporations, partnerships, and trusts.

Repudiated

When a party refuses to acknowledge or fulfill their contractual obligations, effectively rejecting the contract.

Enforceability

The capability of a contract or legal agreement to be legally compelled or upheld in a court of law.

Capacity

The legal ability, competency, or power of an individual or entity to enter into binding contracts or perform some act.

Q3: A currency forward contract specifies all of

Q6: Which of the following is NOT a

Q16: Consider the following equation:<br>S × <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1626/.jpg"

Q34: Assume that Kinston's new machine will be

Q36: Which of the following statements regarding poison

Q44: When choosing between projects,an alternative to comparing

Q56: The incremental EBIT for the Shepard Industries

Q84: The NPV of manufacturing the armatures in

Q90: Consider a four-year,default-free bond with an annual

Q92: Which of the following statements is FALSE?<br>A)Investors