Use the information for the question(s)below.

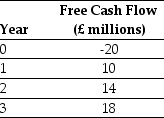

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-What is the dollar present value of the project?

Definitions:

Nonindustrialized Cultures

Societies that have not undergone extensive industrialization and often maintain traditional ways of life.

Fluid Intelligence

The ability to think abstractly, reason, identify patterns, and solve problems with new information.

Crystallized Intelligence

Cognitive skills and specific knowledge acquired over a lifetime; it is heavily dependent on education and tends to remain stable over time.

Deductive Reasoning

A logical process in which a conclusion is based on the concordance of multiple premises that are generally assumed to be true.

Q9: Which of the following statements is FALSE?<br>A)If

Q12: If the current rate of interest is

Q25: The credit spread of the B corporate

Q27: Assuming that your capital is constrained,which investment

Q33: Which of the following money market investments

Q46: Which of the following statements is FALSE?<br>A)Long-term

Q47: The term 2/10 net 30 means:<br>A)If the

Q53: You are offered an investment that offers

Q54: The amount that the price of bond

Q57: This period is known as the conglomerate