Use the following information to answer the question(s) below.

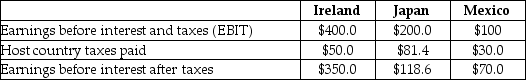

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Irish and Mexican subsidiaries did not exist,the U.S.tax liability on the Japanese subsidiary would be closest to:

Definitions:

Ordinary Income

Income earned from providing services or the sale of goods, as opposed to capital gains or investment income, taxed at standard rates.

Section 179 Expense

A tax deduction that allows businesses to deduct the full purchase price of qualifying equipment and/or software within a tax year.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting wear and tear, decay, or decline in value.

Distribution

The payment of assets from a fund or account to its beneficiaries or shareholders, such as dividends or withdrawals.

Q2: The price per share of this ETF

Q4: Luther's Inventory days is closest to:<br>A)32 days<br>B)59

Q41: Assuming that your capital is constrained,what is

Q41: Which of the following statements is FALSE?<br>A)SEO

Q48: Which of the following statements is FALSE?<br>A)The

Q49: The share of any positive return generated

Q54: The amount that the price of bond

Q63: The NPV for project Beta is closest

Q67: Which of the following statements is FALSE?<br>A)We

Q73: Wyatt Oil is contemplating issuing a 20-year