Use the following information to answer the question(s) below.

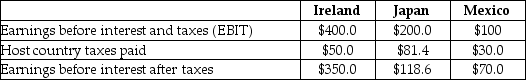

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Irish and Japanese subsidiaries did not exist,the U.S.tax liability on the Mexican subsidiary would be closest to:

Definitions:

Q16: If the Krusty Krab's opportunity cost of

Q26: Bonds issued by a local entity,denominated in

Q28: Which of the following statements is FALSE?<br>A)Depreciation

Q42: In which quarter are Hasbeen's seasonal working

Q51: Which of the following statements regarding mergers

Q82: The price today of a two-year default-free

Q84: The internal rate of return (IRR)for project

Q91: Draw a timeline detailing the cash flows

Q107: If you hold this bond to maturity,the

Q109: Which of the following statements is FALSE?<br>A)If