Use the following information to answer the question(s) below.

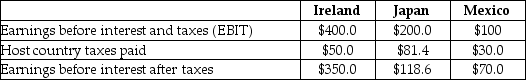

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Incorporated Tools' total U.S.tax liability on its foreign earnings is closest to:

Definitions:

Online Retailers

Companies that operate on the internet and sell goods or services directly to consumers, without a physical storefront.

Pure Competition

A market structure characterized by a large number of firms selling identical products, making it easy for entry and exit, and ensuring no single firm can influence market prices.

Many Sellers

A market condition characterized by the presence of numerous vendors, promoting competition and providing a wide range of options for consumers.

Similar Product

A product that serves the same purpose or functions in a similar manner to another product, often considered to be a competitor.

Q4: The NPV of this project in Euros

Q5: The present value of the £5 million

Q12: Larry should:<br>A)reject the offer because the NPV

Q16: Which of the following statements is FALSE?<br>A)In

Q18: Assume the appropriate discount rate for this

Q29: Which of the following statements is FALSE?<br>A)Many

Q31: Which of the following statements is FALSE?<br>A)The

Q38: Consider a five-year,default-free bond with an annual

Q39: In January 2010,the U.S.Treasury issued a $1000

Q42: The percentage of Wyatt's receivables that are