Use the following information to answer the question(s)below.

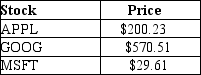

An exchange traded fund (ETF)is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of Apple Inc.(APPL),one share of Google (GOOG),and ten shares of Microsoft (MSFT).Suppose the current stock prices of each individual stock are as shown below:

-If the ETF is currently trading for $1200,what arbitrage opportunity is available? What trades would you make?

Definitions:

Residual Value

The estimated value that an asset will have at the end of its useful life, after it has been depreciated.

Present Value

The current value of future monetary amounts or sequences of cash inflows, factoring in a specific rate of interest.

Annuity

A monetary tool that issues a predetermined sequence of payments to someone, commonly used to generate an income for those who have retired.

Earnings Rate

The rate at which a company or investment generates income relative to a specific amount of assets, capital, or equity.

Q6: The Black-Scholes value of a one-year,at-the-money put

Q8: Which of the following statements is FALSE?<br>A)Any

Q12: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1626/.jpg" alt="Consider

Q19: Assuming that this is the venture capitalist's

Q23: In June 2016,the spot exchange rate for

Q28: The price (expressed as a percentage of

Q35: The cash conversion cycle (CCC)is defined as:<br>A)Inventory

Q60: Consider the following timeline detailing a stream

Q64: Dagny Taggart is a graduating college senior

Q103: A 4 year default free security with