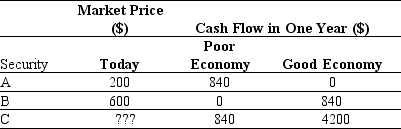

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,then the price for this risky security is closest to:

Definitions:

Replacement Cost

The current cost of replacing an asset with a new one of the same kind and quality.

Inventory Turnover

A metric that measures the number of times a company sells and replaces its stock of goods during a certain period.

Lower of Cost

This accounting principle requires that the inventory or stock should be reported at the lower of its cost or the market value.

Market Method

An appraisal technique used to determine the value of an asset based on the current market price of comparable assets.

Q1: The amount of money the underwriter will

Q22: What is the failure cost index of

Q23: Compute the yield to maturity for each

Q35: Consider the following equation:<br>C = P +

Q37: Suppose that security C had a risk

Q41: Packaging a portfolio of financial securities and

Q43: If Rearden pays no premium to buy

Q44: Which of the following statements is FALSE?<br>A)The

Q51: Suppose that the post IPO value of

Q58: Assuming the appropriate YTM on the Sisyphean