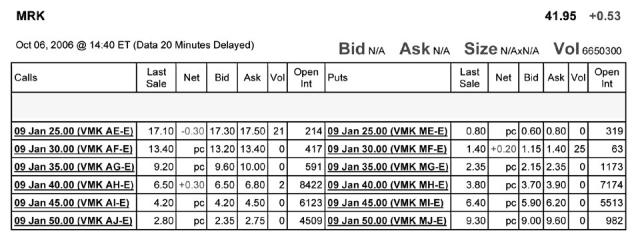

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-Assume you want to buy one option contract that with an exercise price closest to being at-the-money and that expires January 2009.The current price that you would have to pay for such a contract is:

Definitions:

Central Processing Unit

The primary component of a computer that performs most of the processing inside a computer, executing instructions from programs.

Operating System

The software that manages hardware resources and provides common services for computer programs, acting as an intermediary between users and the computer hardware.

Memory Management

The process of controlling and coordinating computer memory, involving the allocation and deallocation of memory blocks to programs to ensure optimal performance.

Input/Output Activities

Operations in computer programming that involve reading data from an external source or writing data to an external destination.

Q2: The effective annual rate for Taggart if

Q6: Suppose that Iota is able to invest

Q28: The payoff to the holder of a

Q32: Which of the following statements is FALSE?<br>A)If

Q33: Which of the following was NOT a

Q34: Which of the following statements is FALSE?<br>A)A

Q43: A lease where the lessee has the

Q82: The price per share of the ETF

Q86: What is the overall expected payoff to

Q90: U.S.public companies are required to file their