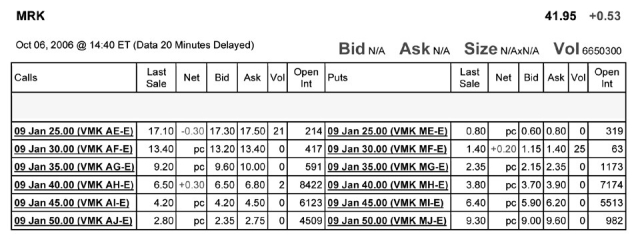

Use the table for the question(s)below.

Consider the following information on options from the CBOE for Merck:

-You have decided to sell (write)5 January 2009 put options on Merck with an exercise price of $45 per share.How much money will you receive and are these contracts in or out of the money?

Definitions:

Longitudinal

A research design or study that follows subjects over a period of time, allowing for the observation of long-term effects or changes.

Participants

Individuals who take part in a research study or experiment.

Impulsive

Characterized by actions taken without forethought or consideration of the consequences; spontaneous behavior.

Conservative

A political and social ideology that emphasizes the value of traditional institutions and practices, resistance to rapid change, and cautiousness in political and social reform.

Q5: The unlevered beta for Luxottica is closest

Q19: Directors who are employees,former employees,or family members

Q19: Assuming that Rearden's annual lease payments are

Q42: Using the binomial pricing model,the calculated price

Q43: Which of the following statements is FALSE?<br>A)Under

Q43: Which of the following statements is FALSE?<br>A)In

Q44: Graph the payoff at expiration of a

Q66: A(n)_ may occur if a major shareholder

Q69: Which of the following statements is FALSE?<br>A)No

Q90: U.S.public companies are required to file their