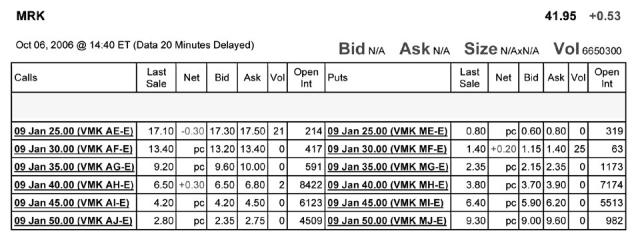

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-Assume you want to buy one option contract that with an exercise price closest to being at-the-money and that expires January 2009.The current price that you would have to pay for such a contract is:

Definitions:

Confused

Lacking clarity or understanding; disoriented in thoughts or awareness.

Combative

Showing an eagerness to fight or be aggressive.

Colleague

A person with whom one works, especially in a profession or business, often sharing similar responsibilities or goals.

Restrain

To limit the movement of someone or something by physical force or legal constraints, often for safety or control purposes.

Q7: Which of the following statements is FALSE?<br>A)It

Q24: The IRR on the investments made by

Q24: If Luther decides to pay the dividend

Q27: Collection float is made up of all

Q29: What is the expected payoff to debt

Q33: Which of the following statements is FALSE?<br>A)Firms

Q34: When a private equity firm purchases the

Q38: Luther Corporation's stock price is $39 per

Q45: The two different types of node on

Q48: Assume that Omicron uses the entire $50