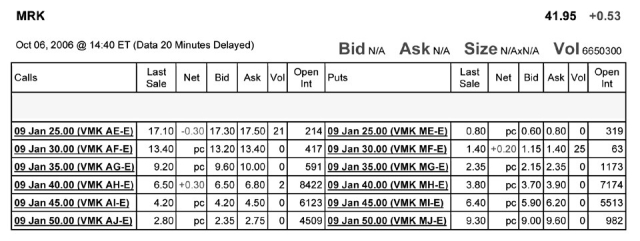

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-Assume it is now January of 2007 and the current risk-free interest rate is 1%.Using Put-Call Parity and the January 30 option (ask price) ,estimate the relative contribution of the near-term dividends to the value of Merck's stock.

Definitions:

Conservation

The practice of protecting Earth's natural resources and biodiversity to sustain ecological balance and ensure their availability for future generations.

Egocentrism

A cognitive bias where an individual is unable to understand or assume any perspective other than their own, commonly seen in early child development stages.

Concrete Operations

A stage in Piaget's theory of cognitive development where children aged 7 to 11 years can logically think about concrete events and objects.

Bilingual

Using or capable of using two languages with nearly equal or equal facility.

Q16: Assuming you get 50% control of Associated

Q17: Using risk neutral probabilities,calculate the price of

Q20: IF FBNA increases leverage so that its

Q22: Which of the following statements is FALSE?<br>A)There

Q22: Which of the following statements is FALSE?<br>A)Stocks

Q23: Consider the following equation:<br>C = S ×

Q28: The Sarbanes-Oxley Act (SOX)forced companies to validate

Q36: Consider the following equation:<br>R<sub>wacc</sub> = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1626/.jpg"

Q44: Which of the following statements is FALSE?<br>A)The

Q61: The idea that once a manager makes