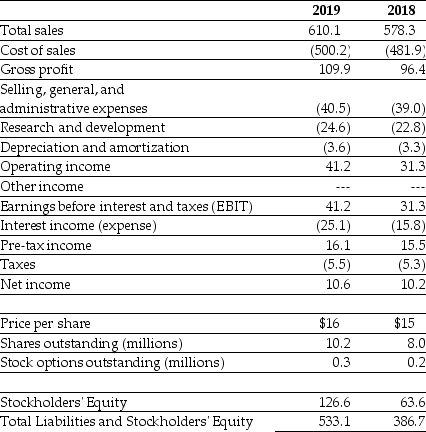

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther Corporation

Consolidated Income Statement

Year ended December 31 (in $ millions)

-Wyatt Oil has a net profit margin of 4.0%,a total asset turnover of 2.2,total assets of $525 million,and a book value of equity of $220 million.Wyatt Oil's current return-on-assets (ROA) is closest to:

Definitions:

NPV Projects

Projects evaluated using Net Present Value, a method for determining the present value of future cash flows, minus the initial investment.

Compromise Policy

A strategy or decision that is made by finding a middle ground between two opposing positions or interests.

Dividend Cuts

Dividend cuts occur when a company reduces the size of the dividend payments to its shareholders, often as a response to financial difficulties or the need to conserve cash.

Q11: The free cash flow to equity in

Q13: If Flagstaff currently maintains a .5 debt

Q22: Which of the following statements is FALSE?<br>A)Before

Q26: The free cash flow to equity in

Q44: Suppose that MI has zero-coupon debt with

Q44: Which of the following statements regarding the

Q47: Which of the following statements is FALSE?<br>A)In

Q74: In 2005,assuming an average dividend payout ratio

Q81: Which of the following statements is FALSE?<br>A)Unlike

Q86: Calculate the debt capacity of Omicron's new