Use the tables for the question(s) below.

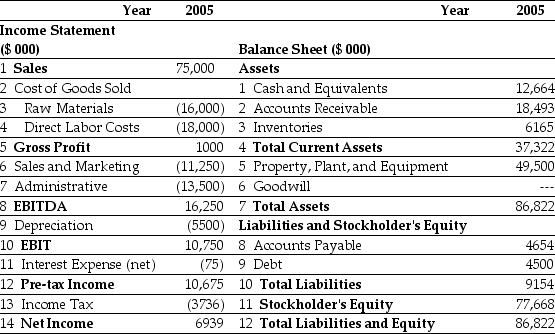

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation  The following are financial ratios for three comparable companies:

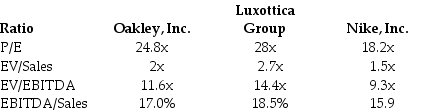

The following are financial ratios for three comparable companies:

-Based upon the average P/E ratio of the comparable firms,Ideko's target market value of equity is closest to:

Definitions:

Sensitive Person

An individual who experiences emotions deeply and may be more affected by external events compared to the average person.

Criticism

The act of expressing disapproval or finding faults in something or someone, often including suggestions for improvement.

Extinguish Horseplay

Efforts to stop playful, often inappropriate and unproductive behavior in a work or serious environment.

Employee Horseplay

Unprofessional behavior at work consisting of playful or prankish activities that can lead to distractions, accidents, or harm.

Q13: Which of the following statements is FALSE?<br>A)Unlike

Q14: Which of the following statements is FALSE?<br>A)In

Q18: Assume that investors hold Google stock in

Q21: Which of the following money market investments

Q28: What will Luther's balance sheet look like

Q37: Suppose that the managers at Rearden Metal

Q39: Assuming Luther issues a 5:2 stock split,then

Q39: The Black-Scholes Δ of a one-year,at-the-money call

Q62: If Flagstaff currently maintains a .5 debt

Q75: Suppose that the managers at Rearden Metal