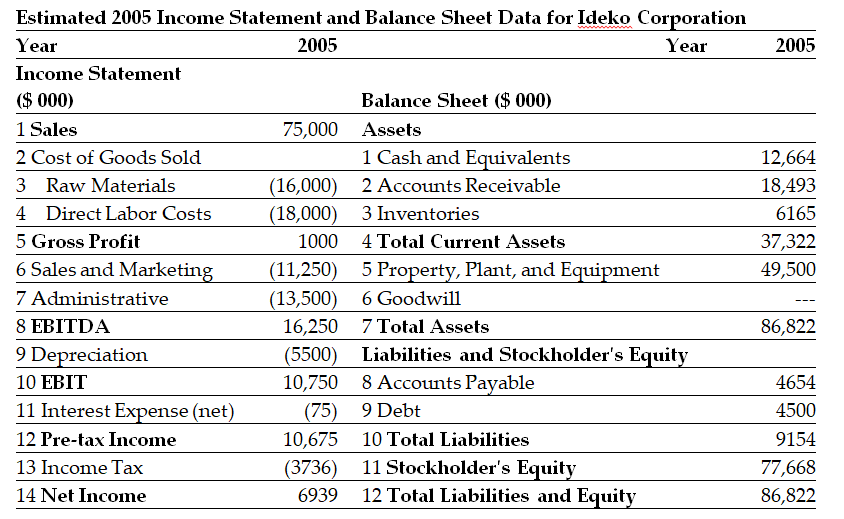

Use the tables for the question(s) below.

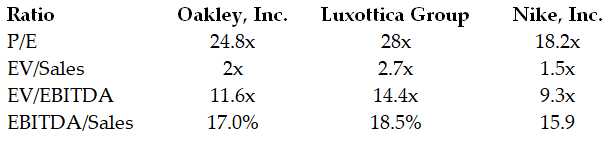

The following are financial ratios for three comparable companies:

-What range for the market value of equity for Ideko is implied by the range of EV/Sales multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

Definitions:

Operating Leverage

The extent to which a company uses fixed costs in its cost structure, impacting its earnings volatility.

Net Operating Income

Net Operating Income (NOI) is a financial metric that calculates a company's income after all operating expenses, excluding taxes and interest, have been deducted from total revenue.

Salesvolume

Sales volume refers to the number of units of a product or service sold by a company in a specified period.

Pay Period

The span of time over which an employee's work hours are recorded and paid.

Q18: Assume that Kinston has the ability to

Q34: Suppose that to fund this new project,Aardvark

Q39: Wyatt Oil purchases goods from its suppliers

Q39: Assume that investors hold Google stock in

Q56: Which of the following statements is FALSE?<br>A)Personal

Q60: Based upon the three comparable firms,calculate that

Q66: Luther Industries is considering borrowing $500 million

Q81: What is the overall expected payoff under

Q86: Two separate firms are considering investing in

Q103: Which of the following is unlikely to