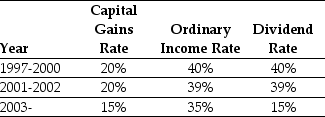

Use the information for the question(s) below.

Consider the following tax rates:  *The current tax rates are set to expire in 2008 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire in 2008 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-The effective dividend tax rate for a buy and hold individual investor in 2006 is closest to:

Definitions:

Pipeline

In supply chain, refers to the flow of goods and materials from the supplier to the customer, as well as the processes that move products through the stages of production to delivery.

High-value Products

Goods or services that provide significant value to the customer, often due to their quality, uniqueness, or customization.

Low-value Products

Goods characterized by relatively low unit cost and often perceived as having lower importance or priority in inventory management and logistics planning.

Third-party Logistics (3PL)

A service provided by companies that manage and execute logistics operations for other businesses, including warehousing, transportation, and distribution.

Q2: Which of the following statements is FALSE?<br>A)If

Q3: The alpha that investors in Galt's fund

Q7: Suppose the risk-free interest rate is 4%.If

Q18: Consider the following equation:<br>R<sub>wacc</sub> = r<sub>U</sub> -

Q22: Assume that you are an investor with

Q39: Assume that investors hold Google stock in

Q40: The market value of Luther's non-cash assets

Q43: The unlevered beta for Nike is closest

Q63: Suppose that Rearden Metal made a surprise

Q72: The CAPM does not require investors have