Use the following information to answer the question(s) below.

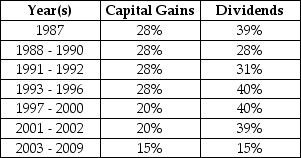

-The effective dividend tax rate in 1989 is closest to:

Definitions:

Planning

The process of setting goals, developing strategies, and outlining tasks and schedules to achieve the objectives set.

Company's Objectives

are the specific, quantifiable targets set by a business aiming to guide its operations towards achieving its strategic goals.

Courses of Action

Refers to the different strategies or paths that can be taken to achieve a goal or solve a problem.

Controlling

A phase in the management process that consists of monitoring the operating results of implemented plans and comparing the actual results with the expected results.

Q11: You have decided to sell (write)5 January

Q14: Which of the following statements is FALSE?<br>A)Whether

Q26: Which of the following statements is FALSE?<br>A)In

Q28: Consider the following formula:<br>V<sub>L</sub> = V<sub>U</sub> +

Q28: The payoff to the holder of a

Q30: The after tax interest expense in 2010

Q53: The statement of financial position is also

Q64: The unlevered cost of capital for "Eenie"

Q66: A(n)_ may occur if a major shareholder

Q98: The unlevered beta for Blinkin is closest