Use the following information to answer the question(s) below.

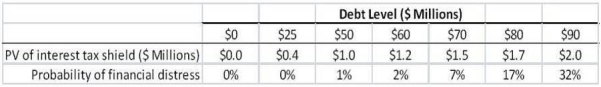

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $10 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

CPU

The Central Processing Unit, a primary component of a computer that performs most of the processing inside a computer.

SuperFetch

A technology in Windows that pre-loads frequently used applications into memory to reduce loading times.

Windows

An operating system developed by Microsoft, widely used on personal computers, featuring a graphical user interface.

RAM

A type of computer memory that is accessible faster than permanent storage, enabling efficient data processing and program execution.

Q7: Suppose the risk-free interest rate is 4%.If

Q11: If Wyatt Oil distributes the $70 million

Q13: If the risk-free rate is 3% and

Q41: Luther Industries does not pay dividend and

Q44: Nielson's share price is closest to:<br>A)$20.80<br>B)$24.40<br>C)$27.50<br>D)$31.20

Q52: The payoff to the holder of a

Q61: The difference between the weighted-average cost of

Q76: Louie's Truck Repair has assets with a

Q86: The income that would be available to

Q94: The effective tax disadvantage for retaining cash