Use the following information to answer the question(s) below.

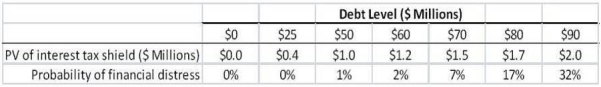

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $25 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Partnership

A legally recognized form of enterprise where the management and earnings are divided among two or more partners.

Securities and Exchange Commission

A government agency responsible for regulating the securities industry, enforcing federal securities laws, and ensuring market integrity.

U.S. Financial Markets

A broad term encompassing all markets where buyers and sellers engage in the trade of financial securities like stocks and bonds within the United States.

External User

External users are individuals or entities outside a company who use financial statements to make decisions about the company, such as investors and creditors.

Q1: Based upon Ideko's Sales and Operating Cost

Q4: KD Industries stock is currently trading at

Q21: Which of the following is NOT considered

Q47: The effective dividend tax rate for a

Q50: Luther's Net Profit Margin for the year

Q53: According to study by Berk and van

Q64: Assume that the Wilshire 5000 currently has

Q84: Galt Industries has a market capitalization of

Q104: The a<sub>i</sub> in the regression:<br>A)measures the sensitivity

Q123: Which of the following statements is FALSE?<br>A)While