Use the following information to answer the question(s) below.

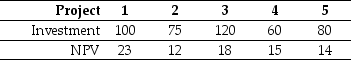

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-The total debt overhang associated with accepting project 1 is closest to:

Definitions:

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or the business's operating cycle, whichever is longer.

Q9: Nielson's EPS if they change their capital

Q9: Zoe Dental Implements has gross property,plant and

Q18: The value of Luther without leverage is

Q32: In describing Galt's equity as a call

Q43: The weighted average cost of capital for

Q50: When investors imitate each other's actions,this is

Q55: Which of the following equations would NOT

Q63: Your firm is planning to invest in

Q74: The equity cost of capital for "Miney"

Q133: Calculate the covariance between Stock Y's and