Use the following information to answer the question(s) below.

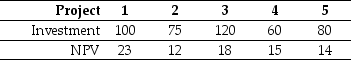

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-If Nielson Motors invests in only those projects which are beneficial to the stockholders,then the total debt overhang associated with accepting these project(s) is closest to:

Definitions:

Saving Rate

The portion of income that is not spent on consumption but instead is saved or invested.

Aggregate Demand

The sum of all expenditures for goods and services.

GDP

The total monetary value of all goods and services produced within a country's borders in a specific time period.

Health Care Costs

The expenses associated with medical services, including treatments, medications, hospital stays, and preventive care measures.

Q3: i)If KD can repurchase its existing shares

Q6: Suppose that you borrow $30,000 in financing

Q24: If Rockwood finances their expansion by issuing

Q25: Investors that suffer from a familiarity bias:<br>A)prefer

Q44: Nielson's share price is closest to:<br>A)$20.80<br>B)$24.40<br>C)$27.50<br>D)$31.20

Q46: The expected return of a portfolio that

Q59: Assume that to fund the investment Taggart

Q61: Which of the following statements is FALSE?<br>A)The

Q61: Suppose you are a shareholder in Galt

Q100: Luther Corporation's cash ratio for 2009 is