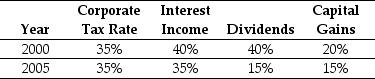

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,assuming an average dividend payout ratio of 50%,the effective tax rate for equity holders was closest to:

Definitions:

Aaron Beck

A psychiatrist and psychotherapist known for pioneering cognitive therapy and his influential work on depression.

Carl Rogers

An influential American psychologist who founded person-centered therapy, emphasizing the importance of a supportive and understanding environment for personal growth.

Positive Psychology

A branch of psychology that focuses on enhancing human functioning by studying strengths, virtues, and factors that contribute to a fulfilling life.

Adaptive

The ability or characteristic of adjusting to new conditions or environments.

Q6: Assuming that Ideko has a EBITDA multiple

Q16: The weight on Wyatt Oil stock in

Q25: Following the borrowing of $12 million and

Q28: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1626/.jpg" alt="The term

Q29: Your estimate of the asset beta for

Q33: Which of the following statements is FALSE?<br>A)Leverage

Q44: Suppose the risk-free interest rate is 4%.If

Q52: Assume that capital markets are perfect,you issue

Q56: In which years were dividends tax disadvantaged?<br>A)1987

Q88: In 2006,Luther Incorporated paid a special dividend