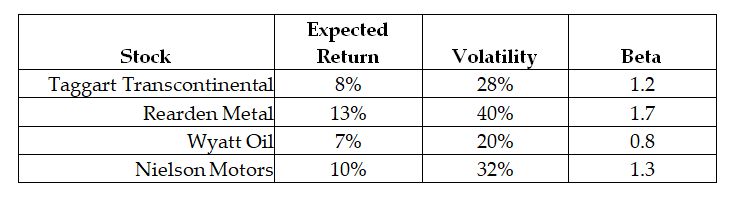

Use the following information to answer the question(s) below.

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-The expected alpha for Wyatt Oil is closest to:

Definitions:

Capital Rationing

The practice of limiting investments or expenditures in new projects due to budget constraints or capital availability.

IRR

IRR (Internal Rate of Return) is a financial metric used to evaluate the profitability of an investment, representing the interest rate at which the net present value of cash flows from the investment is zero.

Initial Investments

The initial amount of money put into a project or venture at the start of its operation.

Cost of Capital

The rate of return that a company must pay to its capital providers, including both debt and equity, to finance its assets.

Q1: Which of the following statements is FALSE?<br>A)The

Q2: Which of the following statements is FALSE?<br>A)If

Q12: Which of the following statements is TRUE?<br>A)Portfolios

Q19: The weighted average cost of capital for

Q52: Calculate the correlation between Stock Y's and

Q58: Suppose that you have invested $30,000 invested

Q61: The effective tax disadvantage for retaining cash

Q78: Suppose that the managers at Rearden Metal

Q87: A(n)_ is the most common way that

Q106: The logical specification, physical requirements, and budget