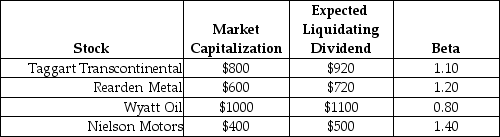

Use the following information to answer the question(s) below.  All amounts are in millions.

All amounts are in millions.

-The correlation between the expected return and the market capitalization of these stocks is:

Definitions:

Second Paragraph

The portion of text that directly follows the first paragraph, often expanding on an introduction or moving into more specific detail.

Claim Message

Communication that asserts a viewpoint or seeks to convince others of something.

Outlining

Drafting a structured summary or overview of a project, document, or presentation.

Corrective Action

Measures taken to identify and rectify a fault or deviation from a standard or desired outcome.

Q25: Following the borrowing of $12 million and

Q29: Assume that MM's perfect capital market conditions

Q29: Which of the following statements is FALSE?<br>A)Aside

Q49: The term a<sub>s </sub>is a(n):<br>A)error term that

Q58: Suppose that you have invested $30,000 invested

Q79: Assume that investors in Google pay a

Q87: Your estimate of the asset beta for

Q92: The amount of Rosewood's interest tax shield

Q96: If Wyatt Oil distributes the $70 million

Q168: The system test verifies the new system