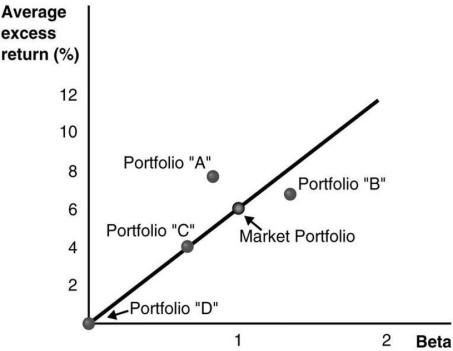

Use the figure for the question(s) below.Consider the following graph of the security market line:

-Which of the following statements regarding portfolio "B" is/are correct? 1.Portfolio "B" has a positive alpha.

2.Portfolio "B" is overpriced.

3.Portfolio "B" is less risky than the market portfolio.

4.Portfolio "B" should not exist if the market portfolio is efficient.

Definitions:

Carrying Amount

The book value of an asset or liability, determined according to the relevant accounting standards.

Unamortized Discount

The portion of a bond's original issue discount (OID) that has not yet been amortized or expensed over the term of the bond.

Unamortized Premium

An unamortized premium refers to the remaining amount of a premium above the face value of a bond that has not yet been expensed over the bond's life.

Market Rate

The prevailing interest rate available in the marketplace for securities or loans at any given time.

Q2: If Wyatt Oil distributes the $70 million

Q8: According to MM Proposition 1,the stock price

Q9: Which of the following statements is FALSE?<br>A)Nonzero

Q11: Galt's WACC is closest to:<br>A)10.6%<br>B)11.2%<br>C)11.8%<br>D)12.5%

Q14: Which of the following statements is FALSE?<br>A)Investors

Q35: The user-directed test runs a subset of

Q77: Assume that five years have passed since

Q81: Which of the following equations is INCORRECT?<br>A)E[R<sub>xCML</sub>]

Q94: Which of the following statements is FALSE?<br>A)There

Q108: Suppose that MI has zero-coupon debt with