Multiple Choice

Use the following information to answer the question(s) below.

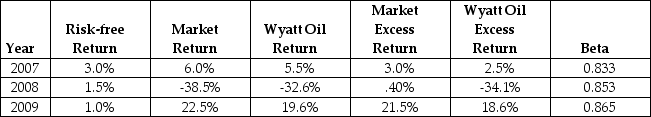

-Using the average historical excess returns for both Wyatt Oil and the Market portfolio estimate of Wyatt Oil's Beta.When using this beta,the alpha for Wyatt oil in 2007 is closest to:

Definitions:

Related Questions

Q15: Your firm currently has $250 million in

Q17: Suppose over the next year Ball has

Q19: As a user, the accountant could become

Q58: Which of the following statements is FALSE?<br>A)The

Q61: The design of interfaces involves how to

Q68: The beta for the portfolio of the

Q76: Louie's Truck Repair has assets with a

Q79: Suppose that you want to use the

Q108: The Sharpe Ratio for the market portfolio

Q166: _ reflects a set of procedures conducted