Use the following information to answer the question(s) below.

-Which of the following statements is FALSE?

Definitions:

Exercise Price

The cost at which an option's holder has the right to purchase or sell the asset underlying the option.

Expiration Date

The last day on which an option or derivative contract is valid, after which it either becomes worthless or is automatically settled.

American Put Option

A derivative security that gives the holder the right, but not the obligation, to sell a specified quantity of an underlying asset at a set price within a specified time.

Striking Price

The specified price at which the holder of an option can buy (call option) or sell (put option) the underlying asset.

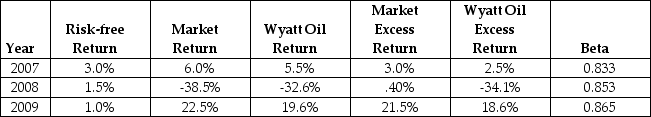

Q16: What is the excess return for the

Q37: Following the borrowing of $12 million and

Q40: The development team must layout the database

Q45: Suppose that the managers at Rearden Metal

Q62: If Flagstaff currently maintains a .5 debt

Q70: Which of the following statements is FALSE?<br>A)In

Q73: The value of KD's unlevered equity is

Q79: Suppose that BBB pays corporate taxes of

Q81: Assuming Luther issues a 25% stock dividend,then

Q103: Enterprise systems are often implemented using the