Use the following information to answer the question(s) below.

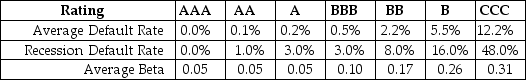

Consider the following information regarding corporate bonds:

-Rearden Metal has a bond issue outstanding with ten years to maturity,a yield to maturity of 8.6%,and a B rating.The bondholders expected loss rate in the event of default is 50%.Assuming a normal economy the expected return on Rearden Metal's debt is closest to:

Definitions:

Private Goods

Goods that are excludable and rivalrous, meaning their consumption by one individual prevents another from consuming them.

Public Goods

Goods that are non-excludable and non-rivalrous, meaning they can be used by everyone and one person's use does not diminish another's.

Government

The organized assembly or body of individuals leading a structured society, typically a nation.

Monopolies

Market structures characterized by a single seller facing no competition in offering a unique product or service.

Q21: If shareholders are unhappy with a CEO's

Q26: The effective dividend tax rate in 1999

Q39: Which of the following statements is FALSE?<br>A)A

Q39: The outcome of the _ process will

Q42: The amount of additional cash that d'Anconia

Q45: Within the characteristics of systems development methodology,

Q51: One factor that can affect the market

Q76: Assuming your cost of capital is 6

Q77: Which of the following statements is FALSE?<br>A)Since

Q123: Which of the following statements is FALSE?<br>A)While