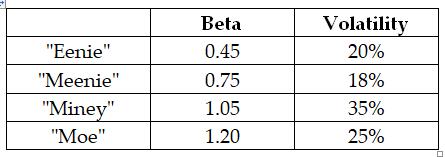

Use the following information to answer the question(s) below

Assume that the risk-free rate of interest is 3% and you estimate the market's expected return to be 9%.

-The equity cost of capital for "Meenie" is closest to:

Definitions:

Stress Decreases

Refers to the reduction in the force per unit area exerted on a material or structure.

Stress Consistently

implies the continuous application or presence of force on an object or material over a period of time.

Seismic Waves

Waves of energy that travel through the Earth's layers, produced by earthquakes or other earth movements, used to study the interior of the Earth.

Epicenter

The point on the Earth's surface that is directly above the focus of an earthquake, where the seismic waves are felt most strongly.

Q12: Assuming that the risk-free rate is 4%

Q28: Consider the following formula:<br>V<sub>L</sub> = V<sub>U</sub> +

Q45: Which of the following is NOT one

Q50: Which of the following is not a

Q54: Suppose that to raise the funds for

Q55: Which of the following statements is FALSE?<br>A)To

Q98: What is the excess return for Treasury

Q105: Assume that in the event of default,20%

Q106: The logical specification, physical requirements, and budget

Q153: Which of the following statement regarding use