Use the following information to answer the question(s) below.

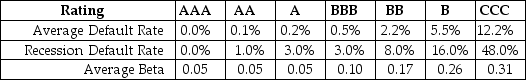

Consider the following information regarding corporate bonds:

-Nielson Motors plans to issue 10-year bonds that it believes will have an BBB rating.Suppose AAA bonds with the same maturity have a 3.5% yield.Assume that the market risk premium is 5% and the expected loss rate in the event of default on the bonds is 60%.The yield that these bonds will have to pay during average economic times is closest to:

Definitions:

Surveys

Questionnaires and interviews that ask people directly about their experiences, attitudes, or opinions.

Sample's Size

The number of individual observations or data points used in a statistical analysis, which can significantly affect the reliability and validity of the study's conclusions.

Respondents' Anonymity

A principle in research and surveys ensuring that the identities of participants are not connected with the information they provide.

Correlation

A statistical measure that indicates the extent to which two or more variables fluctuate together.

Q3: The alpha that investors in Galt's fund

Q13: A(n) _ is a firm providing information

Q25: Do corporate decisions that increase the value

Q34: Assuming that Tom wants to maintain the

Q34: Which firm has the most total risk?<br>A)Eenie<br>B)Meenie<br>C)Miney<br>D)Moe

Q47: Explain why the market portfolio proxy may

Q86: Two separate firms are considering investing in

Q90: Which of the following is one unintended

Q102: Which of the following statements is FALSE?<br>A)The

Q122: Which of the following involves the successful