Use the following information to answer the question(s) below.

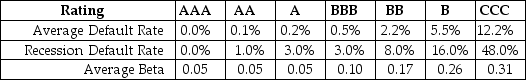

Consider the following information regarding corporate bonds:

-Nielson Motors plans to issue 10-year bonds that it believes will have an BBB rating.Suppose AAA bonds with the same maturity have a 3.5% yield.Assume that the market risk premium is 5% and the expected loss rate in the event of default on the bonds is 60%.The yield that these bonds will have to pay during a recession is closest to:

Definitions:

Return on Assets

A measure of how effectively a company is using its assets to generate earnings.

Revenues

Revenues are the total amount of money received by a company for goods sold or services provided during a specific period.

Expenses

Costs incurred in the process of earning revenue, often categorized into operating and non-operating expenses.

Balance Sheet

An accounting statement that itemizes the total assets, liabilities, and equity of shareholders at a defined date.

Q11: List five general categories of indirect costs

Q14: If Flagstaff currently maintains a .5 debt

Q44: Portfolio "C":<br>A)is less risky than the market

Q53: Which of the following statements is FALSE?<br>A)With

Q62: If the risk-free rate is 5% and

Q75: Using the data provided in the table,calculate

Q88: The e<sub>i</sub> in the regression:<br>A)measures the market

Q94: The _ documents the system design and

Q113: The expected return on the precious metals

Q146: Making program changes, correcting errors in the