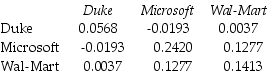

Use the table for the question(s) below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6000 investments in Duke Energy and a $4000 investment in Wal-Mart stock is closest to:

Definitions:

Potential

The inherent ability or capacity for growth, development, or future success.

Common Values

Shared beliefs or standards of behavior that help to unite and guide the members of a group, community, or organization.

Coaching

A developmental process where an experienced individual, known as a coach, supports a learner in achieving a specific personal or professional goal.

Training

The process of teaching or learning specific skills or behaviors, aimed at improving ability or efficiency.

Q3: Which of the following statements is FALSE?<br>A)The

Q13: The value of the oil exploration division

Q53: The expected return on security with a

Q63: Within the approved systems design document, a

Q72: Considering the fact that Luther's Cash is

Q73: Suppose that the risk-free rate is 5%

Q85: Wyatt Oil has a bond issue outstanding

Q97: The beta for the market portfolio is

Q153: Which of the following statement regarding use

Q189: An intangible cost is one that cannot