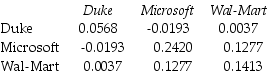

Use the table for the question(s)below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6000 investments in Microsoft and a $4000 investment in Wal-Mart stock is closest to:

Definitions:

Maturity Value

The amount payable to an investor at the end of a fixed-term investment including the principal and the interest.

Compounded Annually

Compounding annually is a method where interest is added to the principal sum at the end of each year, impacting the total interest earned or paid.

Objective

A goal or target that is aimed to be achieved, often used in planning and strategy contexts.

Compounded Semi-Annually

Interest on an investment that is calculated twice a year and added to the principal sum, affecting the total interest earned.

Q18: Which of the following statements is FALSE?<br>A)Beta

Q21: If Rosewood had no interest expense,its net

Q30: Which of the following organization forms for

Q32: Which of the following statements is FALSE?<br>A)The

Q39: Assume that investors hold Google stock in

Q51: The alpha for the informed investors is

Q62: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1626/.jpg" alt="The term

Q90: Which of the following is one unintended

Q95: Show mathematically that the stock price of

Q97: The unlevered beta for Nod is closest