Use the table for the question(s) below.

Consider the following covariances between securities:

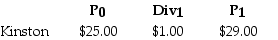

-Suppose you have $10,000 in cash to invest.You decide to sell short $5000 worth of Kinston stock and invest the proceeds from your short sale,plus your $10,000 into one-year U.S.treasury bills earning 5%.At the end of the year,you decide to liquidate your portfolio.Kinston Industries has the following realized returns:

The return on your portfolio is closest to:

Definitions:

Psychological Benefits

The positive effects on mental health and well-being that can result from various activities or treatments.

Muscle Weighs

The mass of muscle tissue in the body, which may contribute to overall weight and physical strength.

Physically Active Children

Children who engage in regular physical activity, which supports their physical development, health, and well-being.

Physically Active People

Individuals who engage in a significant amount of physical activity, leading to enhanced physical health and well-being.

Q5: Which of the following statements is FALSE?<br>A)One

Q22: Which of the following usually would be

Q32: Portfolio "B":<br>A)is less risky than the market

Q33: Suppose an investment is equally likely to

Q43: Assume that you purchased General Electric Company

Q63: Within the approved systems design document, a

Q64: The NPV for this project is closest

Q68: In order for Nielson Motor's to be

Q83: Suppose that you are holding a market

Q85: Monsters' required return is closest to:<br>A)10.0%<br>B)13.0%<br>C)11.5%<br>D)15.5%