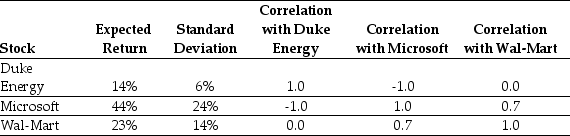

Use the table for the question(s) below.

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Duke Energy and Microsoft.The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to:

Definitions:

Industry Demand

The total demand for the products of a specific industry, encompassing the collective demand of all consumers for these products.

MR Curve

The Marginal Revenue Curve represents the change in total revenue that results from selling one additional unit of a product or service.

Downward Sloping

A descriptive term for a graph line that shows a decrease in value as it moves from left to right, often used in economics to describe demand curves.

Demand Curve

A graph showing the relationship between the quantity of a commodity demanded and its price.

Q1: Wyatt Oil's excess return for 2009 is

Q2: Which of the following statements is FALSE?<br>A)A

Q5: In which role might the accountant be

Q5: The GL/BR process is an interacting structure

Q13: A(n) _ is a firm providing information

Q20: IF FBNA increases leverage so that its

Q21: If Rosewood had no interest expense,its net

Q35: If its managers engage in empire building,then

Q56: With perfect capital markets,what is the market

Q62: The beta for Wyatt Oil is closest