Use the table for the question(s)below.

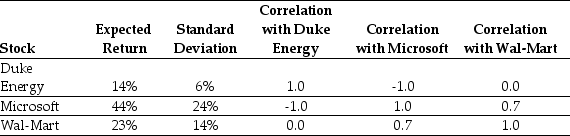

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Microsoft and Wal-Mart stock.Calculate the expected return on such a portfolio when the weight on Microsoft stock is 0%,25%,50%,75%,and 100%

Definitions:

Compound

A chemical substance made up of two or more different elements that are chemically bonded together in a fixed ratio.

Dimethylheptanoic Acid

denotes a hypothetical organic compound, potentially misnamed, suggesting a heptanoic acid derivative substituted with two methyl groups.

γ-hydroxypentanoic Acid

An organic compound characterized by a five-carbon chain with a hydroxyl group attached to the third carbon and a carboxylic acid group at the end.

γ-hydroxy-γ-methylbutyric Acid

An organic compound, structurally related to β-hydroxy-β-methylbutyrate (HMB), and is involved in the biosynthesis and metabolism of fatty acids.

Q8: The Principal-Agent Problem arises:<br>A)because managers have little

Q10: The expected return on the alternative investment

Q11: An investment is said to be liquid

Q24: Nielson Motors should accept those projects with

Q39: The cost of capital for a project

Q51: Suppose that to raise the funds for

Q59: Suppose over the next year Ball has

Q90: Suppose that to raise the funds for

Q139: The following is a jumbled list of

Q146: Making program changes, correcting errors in the