Multiple Choice

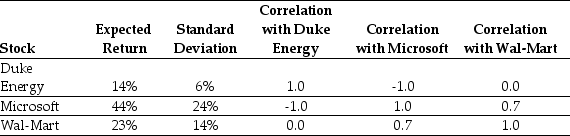

Use the table for the question(s) below.

Consider the following expected returns,volatilities,and correlations:

-Which of the following statements is FALSE?

Comprehend the fundamentals of equity and fairness in economics.

Differentiate between various types of economic relationships as demonstrated through slopes and curves.

Grasp the basic principles of cost production and consumption relationships in economics.

Understand the concept and calculation of the slope in economic models.

Definitions:

Related Questions

Q26: The value of Shepard Industries with leverage

Q32: Galt Industries has 125 million shares outstanding

Q34: Suppose that BBB pays corporate taxes of

Q42: The number of shares that Galt must

Q44: Portfolio "C":<br>A)is less risky than the market

Q44: IF FBNA increases leverage so that its

Q61: The design of interfaces involves how to

Q65: Which of the following statements is FALSE?<br>A)It

Q89: Suppose that to raise the funds for

Q90: If Flagstaff currently maintains a debt to