Use the following information to answer the question(s) below.

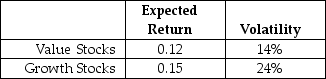

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following is NOT an assumption used in deriving the Capital Asset Pricing Model (CAPM) ?

Definitions:

Self-Directing Teams

Groups of individuals who manage their own workload and operations without the need for direct supervision, often involving collaborative decision making.

Self-Governing Team

A type of team that operates autonomously, making decisions and managing work processes internally without direct oversight from higher management.

Manager-Lead Team

A team directed and overseen by a manager, with a specific focus on achieving set objectives and outcomes.

Manager-Led Team

A team that operates under the direct guidance and supervision of a designated manager.

Q3: Which of the following represent a typical

Q18: Assume that investors hold Google stock in

Q25: Luther's after-tax debt cost of capital is

Q33: Suppose an investment is equally likely to

Q54: The managerial reporting officer is responsible for

Q78: The volatility of your investment is closest

Q81: Which of the following statements is FALSE?<br>A)Securities

Q85: Consider the following equation:<br>Β<sub>U</sub> = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1626/.jpg"

Q87: The expected return for Alpha Corporation is

Q99: Systems maintenance is a set of procedures