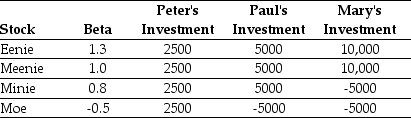

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's Portfolio is closest to:

Definitions:

Competition

The economic rivalry among businesses to attract customers, increase sales, and achieve a higher market share.

Natural Monopoly

A type of monopoly that occurs when a single firm can supply the entire market at a lower cost than any potential competitors, often due to high fixed costs.

Fair Return

A reasonable profit that companies aim for, which covers costs and provides a sustainable margin without being excessive.

Operating Efficiency

The capability of an organization to deliver products or services to its customers in the most cost-effective manner without sacrificing quality.

Q2: MJ Enterprises has 50 million shares outstanding

Q6: Which of the following formulas is INCORRECT?<br>A)Variance

Q54: Which of the following statements is FALSE?<br>A)Because

Q69: In practice which market index is most

Q69: The excess return is the difference between

Q71: Rearden Metal has a bond issue outstanding

Q72: Which of the following statements is FALSE?<br>A)The

Q78: The volatility of your investment is closest

Q171: The post implementation review is an examination

Q199: The following picture from the text illustrates