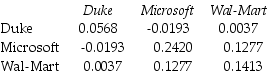

Use the table for the question(s)below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6000 investments in Microsoft and a $4000 investment in Wal-Mart stock is closest to:

Definitions:

Optimistic

An attitude reflecting a belief or hope that the outcome of some specific endeavor, or outcomes in general, will be positive, favorable, and desirable.

Framing Information

The way information is presented or communicated, which can influence perception and decision-making.

Healthful Concept

A healthful concept pertains to ideas or practices that promote physical, mental, and emotional well-being.

Representativeness Heuristic

A cognitive bias in decision making where the likelihood of an event is estimated based on how closely it resembles the typical case.

Q1: Consider the following formula:<br>Τ* = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1626/.jpg"

Q1: Which of the following statements is FALSE?<br>A)The

Q1: Wyatt Oil's excess return for 2009 is

Q13: The covariance between Stock X's and Stock

Q19: Assume that capital markets are perfect except

Q42: In 2005,the effective tax rate for debt

Q57: Which of the following is NOT a

Q60: The business reporting process comprises accumulating, classifying,

Q66: The expected overall payoff to Bank A

Q190: Defining requirements such as the amount of